Each week, we provide an overview of the percent returns of the primary indices in Southeast Asia and their currency appreciation or depreciation relative to the US Dollar. We provide this information below. We also capture this information, as well as the trailing four and year-to-date movements, and plot the data in charts, which you can find on the “index charts” and “currency charts” pages.

Indices

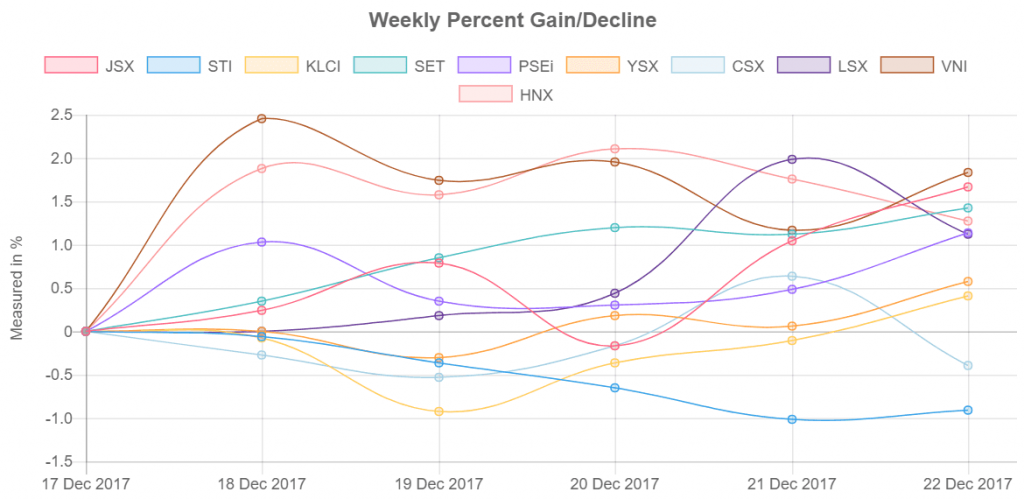

During the week of 18 December, eight of the ten indices in Southeast Asia advanced, with the Ho Chi Minh Stock Exchange having the greatest gain, rising 1.83%. Singapore’s Straits Times Index had the greatest decline, falling 0.91%.

On Thursday, Fitch Ratings raised one level its rating on Indonesia’s long-term, foreign and local currency-denominated debt to BBB with a stable outlook, according to Fitch, which is the firm’s second lowest investment grade rating; Fitch first rated Indonesia’s long-term credit as investment grade in 2011, according to Reuters. S&P Global Ratings and Moody’s Investors Services each currently rate Indonesia’s credit at their lowest level of investment grade, according to Bloomberg.

On Tuesday, Philippine President Rodrigo Duterte signed the Tax Reform for Acceleration and Inclusion (TRAIN) bill, which is the first of five bills associated with the Administration’s tax reform plan. The TRAIN bill will exempt those earning less than PHP 250,000 from income taxes and will impose higher taxes on fuel, cars, tobacco, and sugary beverages—expected to generate PHP 130 billion—to fund infrastructure and development projects of the government, according to Rappler, a Philippine news source.

Weekly gains

- Ho Chi Minh Stock Exchange Index (VNI), 1.83%

- Jakarta Stock Exchange index (JSX), 1.66%

- Stock Exchange of Thailand index (SET), 1.42%

- Hanoi Stock Exchange Index (HNX), 1.27%

- Philippine Stock Exchange index (PSEi), 1.14%

- Lao Securities Exchange index (LSX), 1.12%

- Myanmar’s Myanpix index (YSX), 0.57%

- Kuala Lumpur Composite Index (KLCI), 0.41%

Weekly declines

- Cambodia Securities Exchange index (CSX), -0.39%

- Singapore’s Straits Times Index (STI), -0.91%

Currencies

Six of the nine Southeast Asian currencies advanced relative to the US Dollar the week of 18 December, with the Philippine Peso increasing the most, appreciating 0.64%. The Thai Baht had the greatest decline, falling 0.70%.

Weekly appreciations

- Philippine Peso (PHP), 0.64%

- Singapore Dollar (SGD), 0.37%

- Indonesian Rupiah (IDR), 0.17%

- Lao Kip (LAK), 0.06%

- Vietnamese Dong (VND), 0.03%

- Malaysian Ringgit (MYR), 0.02%

Weekly depreciation

- Cambodian Riel (KHR), -0.12%

- Myanmar Kyat (MMK), -0.37%

- Thai Baht (THB), -0.70%