Each week, we provide an overview of the percent returns of the primary indices in Southeast Asia and their currency appreciation or depreciation relative to the US Dollar. We provide this information below. We also capture this information, as well as the trailing four and year-to-date movements, and plot the data in charts, which you can find on the “index charts” and “currency charts” pages.

Indices

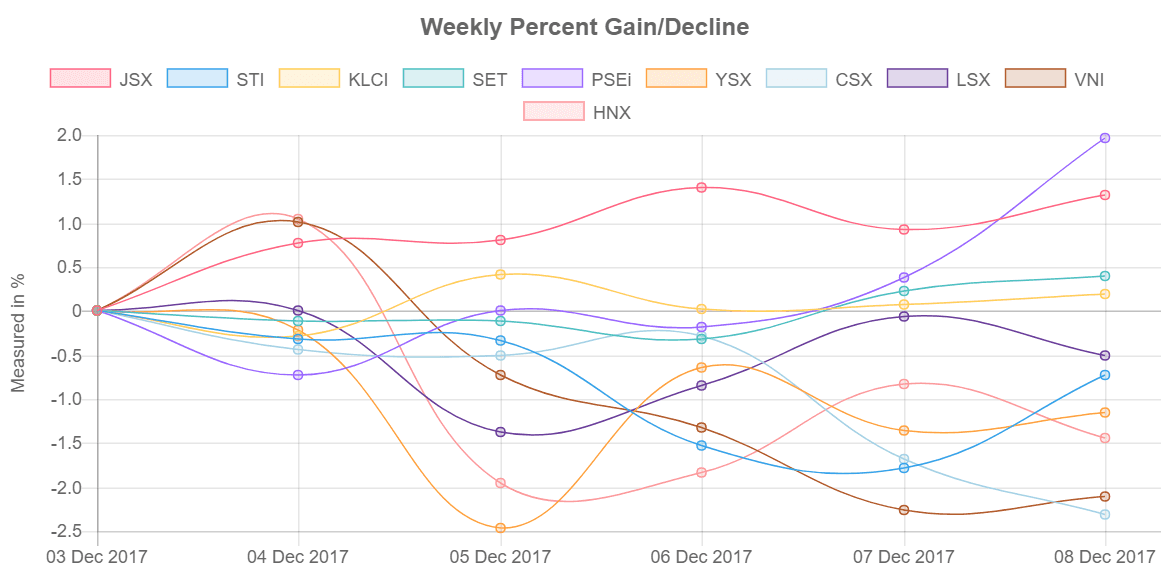

During the week of 4 December, four of the ten indices in Southeast Asia advanced, with the Philippine Stock Exchange index having the greatest gain, rising 1.97%. For the first time since 29 September, Vietnam’s Ho Chi Minh Stock Exchange declined week-over-week, falling 2.10%. The Hanoi Stock Exchange index declined week-over-week for the first time since 3 November, losing 1.45%.

On 6 December, Myanmar’s president signed the Myanmar Companies Act, which will allow foreigners to own up to a 35% stake in local companies and should foster more foreign investor participation in the Myanmar market, according to The Myanmar Times. The business sector has applauded the law but cautions that details still need to be explained, according to The Myanmar Times.

Also in Myanmar, TMH Telecom Public Company announced it would launch an initial public offering in 2018, according to The Myanmar Times, which would make it the fifth company to list on the Yangon Stock Exchange. TMH was established in 2006 and provides engineering services related to mobile and fiber networks, among other offerings.

Weekly gains

- Philippine Stock Exchange index (PSEi), 1.97%

- Jakarta Stock Exchange index (JSX), 1.32%

- Stock Exchange of Thailand index (SET), 0.40%

- Kuala Lumpur Composite Index (KLCI), 0.20%

Weekly declines

- Lao Securities Exchange index (LSX), -0.50%

- Singapore’s Straits Times Index (STI), -0.72%

- Myanmar’s Myanpix index (YSX), -1.16%

- Hanoi Stock Exchange Index (HNX), -1.45%

- Ho Chi Minh Stock Exchange Index (VNI), -2.10%

- Cambodia Securities Exchange index (CSX), -2.32%

Currencies

Two of the nine Southeast Asian currencies advanced relative to the US Dollar the week of 4 December, with the Malaysian Ringgit increasing the most, appreciating a modest 0.04%. The Thai Baht, which year-to-date has been the region’s strongest currency, did not change week-over-week; on 7 December, the Bangkok Post reported that Thailand’s private sector has voiced concerns that the stronger Baht could hurt exports and tourism, as well as the overall economy.

Weekly appreciations

- Malaysian Ringgit (MYR), 0.04%

- Vietnamese Dong (VND), 0.01%

- Cambodian Riel (KHR), 0.00%

- Thai Baht (THB), 0.00%

Weekly depreciation

- Lao Kip (LAK), -0.08%

- Indonesian Rupiah (IDR), -0.12%

- Philippine Peso (PHP), -0.43%

- Singapore Dollar (SGD), -0.44%

- Myanmar Kyat (MMK), -0.50%