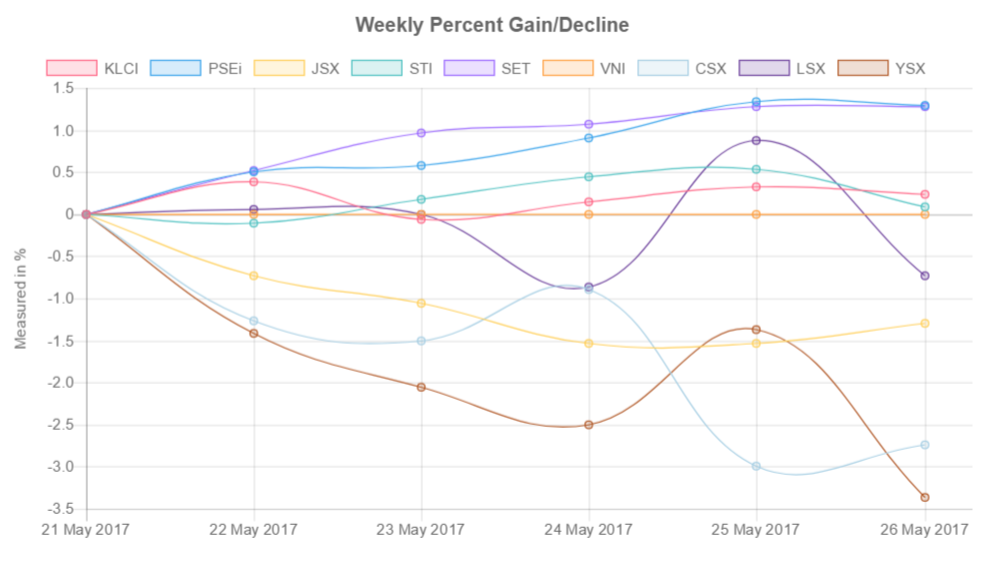

Each week, we provide an overview of the percent returns of the primary indices in Southeast Asia and their currency appreciation or depreciation relative to the US Dollar. We provide this information below. We also capture this information, as well as the trailing four and twelve week movements, and plot the data in charts, which you can find on the “index charts” and “currency charts” pages.

Indices

During the week of 15 May, which saw United States markets experience their greatest daily loss since September, several Southeast Asia indices advanced. The Jakarta Stock Exchange (JSX) reversed earlier losses in the week to lead all indices with a gain of 2.06%—it climbed 2.59% on Friday, possibly in part because Bank Indonesia voted on Thursday afternoon to hold the seven-day reverse repurchase rate at 4.75%, according to the Jakarta Globe.

During the week, several Southeast Asian indices experienced greater than normal correlation with the US’s S&P 500, particularly the Kuala Lumpur Composite Index (KLCI) and Philippine Stock Exchange index (PSEi), which had correlations of 0.84 and 0.80, respectively. For comparison, the KLCI’s and PSEi’s trailing four-week correlation with the S&P 500 is 0.29 and 0.49 respectively, and their trailing twelve-month correlation is -0.06 and 0.01, respectively.

Trading this week on the Lao Securities Exchange—which had the greatest decline of the nine indices—underscored the volatility that can surface in emerging markets, with the LSX jumping 7.92% on Tuesday, only to fall 7.66% the next day. The price movements in the LSX over this two-day period primarily were driven by EDL-Gen, a state-owned energy company, which gained 9.6% on Tuesday and fell by almost an identical percent on Wednesday.

- Similar, drastic price movements previously have occurred on the LSX. In the first week of 2017, the index climbed over 20%, only to fall by 9% and 7% each of the following two weeks; again, EDL-Gen was the driver behind these price movements.

- We previously identified large price fluctuations on the Yangon Stock Exchange in Myanmar, which over a span of five trading days in late February and early March 2017 soared 21%, only to fall 14% over the subsequent trading days. For more information, see “FMI Drives Surge in YSX.”

Weekly gains

- Jakarta Stock Exchange (JSX), 2.06%

- Vietnam All-index (FTFVAS), 1.25%

- Cambodia Securities Exchange (CSX), 1.06%

- Stock Exchange of Thailand (SET), 0.37%

- Myanmar’s Myanpix Index (YSX), 0.07%

Weekly declines

- Kuala Lumpur Composite Index (KLCI), -0.43%

- Philippine Stock Exchange index (PSEi), -0.61%

- Singapore’s Straits Times Index (STI), -1.18%

- Lao Securities Exchange (LSX), -1.96%

Currencies

During the week of 15 May, five of the primary Southeast Asian currencies appreciated relative to the US Dollar, with the Singapore Dollar (SGD) leading all advances at 1.37% and the Myanmar Kyat seeing the greatest decline at 1.06%, brining its trailing twelve-month depreciation relative to the USD to 15%.

Weekly appreciations

- Singapore Dollar (SGD), 1.37%

- Thai Baht (THB), 0.96%

- Malaysian Ringgit (MYR), 0.56%

- Vietnamese Dong (VND), 0.18%

- Philippine Peso (PHP), 0.06%

Weekly depreciation

- Indonesian Rupiah (IDR), -0.04%

- Lao Kip (LAK), -0.10%

- Cambodian Riel (KHR), -0.27%

- Myanmar Kyat (MMK), -1.06%