Each week, we provide an overview of the percent returns of the primary indices in Southeast Asia and their currency appreciation or depreciation relative to the US Dollar. We provide this information below. We also capture this information, as well as the trailing four and year-to-date movements, and plot the data in charts, which you can find on the “index charts” and “currency charts” pages.

Indices

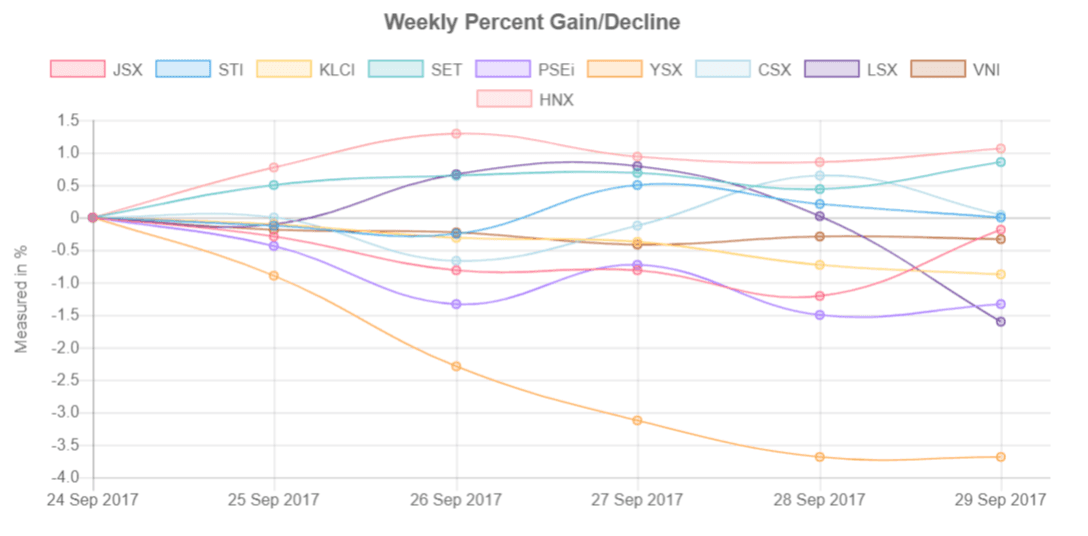

During the week of 25 September, three of the ten indices in Southeast Asia advanced, with the Hanoi Stock Exchange (HNX) index again increasing the most, rising 1.94%. The percent returns of the HNX and the Ho Chi Minh Stock Exchange index (VNI) generally mirrored each other early in 2017, but since late February the HNX significantly has outgained the VNI, increasing 34% year-to-date compared to the VNI’s 21%; year-to-date, the exchanges have a 0.63 correlation.

The Hanoi Stock Exchange generally lists smaller and less established firms than the Ho Chi Minh Stock Exchange. The Hanoi exchange requires contributed capital of at least VND 30 billion, or about USD 1.3 million, and one year of operations as a joint stock company, according to its website, and the Ho Chi Minh exchange requires contributed capital of at least VND 120 billion, or about USD 5.3 million, and two years of operations as a joint stock company, according to its website.

In Singapore, gaming and e-commerce firm Sea, formerly known as Garena, has begun the process to publicly list its shares on the New York Stock Exchange (NYSE), according to The Straits Times. The company is Singapore’s first billion dollar start-up, and it probably is listing on the NYSE, at least in part, because the exchange allows for a dual-class share structure. You can find more information on the Singapore Stock Exchange and why some Singaporean companies are listing on foreign exchanges here.

Weekly gains

- Hanoi Stock Exchange Index (HNX), 1.07%

- Stock Exchange of Thailand index (SET), 0.85%

- Cambodia Securities Exchange index (CSX), 0.04%

Weekly declines

- Singapore’s Straits Times Index (STI), -0.01%

- Jakarta Stock Exchange index (JSX), -0.18%

- Ho Chi Minh Stock Exchange Index (VNI), -0.34%

- Kuala Lumpur Composite Index (KLCI), -0.87%

- Philippine Stock Exchange index (PSEi), -1.33%

- Lao Securities Exchange index (LSX), -1.61%

- Myanmar’s Myanpix index (YSX), -3.69%

Currencies

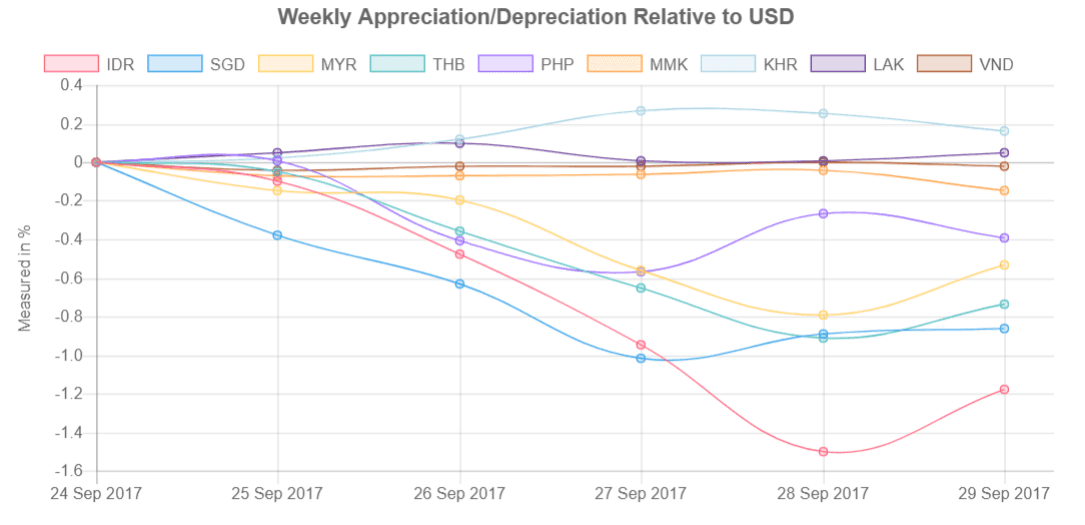

Two of the nine primary Southeast Asian currencies advanced relative to the US Dollar the week of 24 September, with most currencies declining probably in part because the chair of the US Federal Reserve hinted on Tuesday that another rate hike could occur before the end of the year; investors now see a roughly 70% probability of a US rate hike in December, according to Bloomberg.

The Thai Baht, which has been the region’s strongest currency year-to-date, declined approximately three quarters of a percent during the week, probably in part because of the Fed chair’s comments but also because the Bank of Thailand, the country’s central bank, on Wednesday voted unanimously to hold its benchmark rate at 1.50%.

Weekly appreciations

- Cambodian Riel (KHR), 0.16%

- Lao Kip (LAK), 0.05%

Weekly depreciation

- Vietnamese Dong (VND), -0.02%

- Myanmar Kyat (MMK), -0.15%

- Philippine Peso (PHP), -0.39%

- Malaysian Ringgit (MYR), -0.53%

- Thai Baht (THB), -0.74%

- Singapore Dollar (SGD), -0.86%

- Indonesian Rupiah (IDR), -1.18%